Have assignment, will brb…

—————————————————————————————

Cont’d from Part 1… Mark Baum and his little hedge fund team of nerds are on an investigative trip to decide whether there is a Housing Market bubble and they should take on that massive short position betting against it. So they start interviewing housing agents who refer them to the guys selling the loans, these jock Mortgage Brokers, in Dilbert-esque conversations.

Hedgie 1: So… you target.. immigrants.

Mortgage Broker 1: …Their credit actually isn’t bad enough for him <indicates friend> –

Mortgage Broker 2: Trust me, I’m not driving a 7 series without strippers. No one on the (strippers’) pole has good credit and they’re all cash rich.

Hedgie 2: I think I read somewhere Warren Buffet said that once.

Mortgage Brokers: Who’s Warren Buffet?

Hedgie 1: …..Does anyone ever get rejected (for a housing loan)?

Mortgage Broker 2: Seriously? They get rejected, I suck at my job.

Mortgage Broker 1: My firm offers Ninja Loans. No income, no job… I just leave the income section blank. (Come on), these people just want homes…

(So these mortgage brokers are the people who will “save” immigrants and strippers from homelessness. Because Brutus is an Honourable Man.)

Oh, the carnage on culture, the over-use of alliteration… 🙂 In case you’re wondering why I get so fascinated, it’s because it makes absolutely NO. SENSE. Yet somehow, people like the creators of TMNT succeeded in producing a wildly popular pop culture reference. Out of absolute nonsense. What made TMNT fly, where Tattooed Teenaged Alien Fighters From Beverly Hills didn’t?

Turtles aside, take Chanel costume jewellery. What makes coated canvas, bakelite, base metal, glass – even if it IS gripoix – store and appreciate in value like gold (or diamonds*) – when so many countries’ currencies risk devaluation, “just because” it’s got the “Double C” Chanel logo on it?

Barter trade, currency, the keeping of value against depreciation, inflation, governments and politics, it’s all so exciting – what makes that price? We do. It’s all our fault 🙂 The Kardashians get no respect BUT Kylie Jenner surpassed Mark Zuckerberg as youngest self-made billionaire months ago. Who’s Kylie Jenner?

What can I say – Kylie Jenner, youngest half-sister to the Kardashians grew up with the most awful older sister role models, a ridiculous amount of money to fund irresponsible, tasteless behaviour, a dad who is now a woman – all of it under crushing media attention and a powerful social media platform, guaranteeing massive distortion of view. She was 11 years old when the infamous Keeping Up With The Kardashians began. In other words, she has a higher propensity than most girls to turn out pretty messed up. (But YES for the record I can’t stand 90% of their stuff and if you don’t have a childhood that confusing it should be even easier for you to not become a barely-dressed headcase right 🙂 )

Critics of the Forbes article argue she was born into fame and fortune and cannot claim to be self-made, whereupon her biggest car crash of an older half sister Kim Kardashian West (and her other car crash friend Paris Hilton) stood by Jenner to say she deserves the credit. I mean, I wouldn’t dress like them 99.99% of the time <shrugs>, but – Kim Kardashian herself was worth a “paltry” USD 350 million despite all the extreme drama. Her littlest sister about to oust Mark Zuckerberg as youngest billionaire, and she comes out in support.

Before everyone screams at me for bringing up the Kardashians or in any way approving (of course NOT la, for me they’re like from another planet in some MIB spin-off, in which case I have more in common with Frank.)

Can I just point out that the previous holder of the Youngest Billionaire title, Mark Zuckerberg, and how the so-powerful-and-widespread-they-want-their-own-currency-Facebook came about wasn’t exemplary either. Nor was what happened to Zuckerberg’s then-roommate Eduardo Saverin before the conclusion of a painful court battle. They went to Harvard though. Does that make it all better?

Larry Summers, then-president of Harvard, was depicted in The Social Network movie as being extremely unsympathetic to several well-heeled students coming to him and “tattling” that Zuckerberg had stolen their idea. His screen response was “this is Harvard. Everyone’s always making something.” When asked for comment, the real Summers reaffirmed his position, “…If an undergraduate is wearing a jacket and tie 3pm on a Thursday afternoon… he either has a job interview or he is a first class @sshole. In this case, it was the latter,” regarding the the Winklevoss twins and their petition.

(The Winklevosses and fellow student Divya Narendra received ~USD 65 mio in settlement for their original Facebook idea. They were not happy. They were also mostly “blackmarked” from investing in other tech startups. However, they turned USD 11 million of the original Facebook settlement into some USD 1 bio by being some of the earliest investors in Bitcoin (BACK WHEN IT WAS INCREDIBLY CHEAP OK..). I guess I’d call that Well-Heeled Snobs Ticked Harvard President Off For Being Pompous About Being Right, Have To Go To Court. BUT They Didn’t Dwell, Kept Looking For Opportunities, And Became Billionaires Too. Comeback story here)

Quick further aside (to nix any potential gender-profession seeming-bias):

Y’know, in case you thought only people who look like pugs looks, brains and dedication all need to exist together as a constant, in any equation (more on that later)..

ANYWAY, back to Big Short. Ninja Loans, Strippers (censored below), And A Rise In Housing Prices So Rapid If You Had Gotten In AND Out It Would’ve Paid For That First Class Ticket To Get Drinks With Little Umbrellas Sticking Out Of Them In Bali . And the vacation home you were staying in. In case you wanted to go back. Or your friends wanted to. (Imma simple mama, don’t need a whole billion, y’know?):

It. Really. Was NOT rocket science. In yet another eg of how the Jarringly Obvious went unseen, very nearly everyone placed blind faith where they shouldn’t have – no, not re the instrument or asset class, but human nature. Steve Carell (Steve Eisman in real life) who plays Horrified Mark Baum above says, “When you start peeling back layers, it’s actually really, really terrifying.”

Saying “no,”and the people who “said no” (to horribly risky mortgages) looked wayyy less cool than the swaggering brokers who were behaving irresponsibly. Youtube is full of idiots jumping from building to building with cams attached to them – irresponsibility and bravado can look very cool – and Big Short has that, with VERY big numbers to boot. Money. (And there you thought numbers were boring..) Hold that thought…

In the Matrix movie franchise, leader of the human revolution against machines who have enslaved humans’ minds within a virtual reality world so as to harness the energy from their brain activity, Morpheus*, offers all would-be truth seekers a choice: to believe what you want, take the blue pill… but take the red one and discover what the world really is like, outside the one your mind thinks you live in.

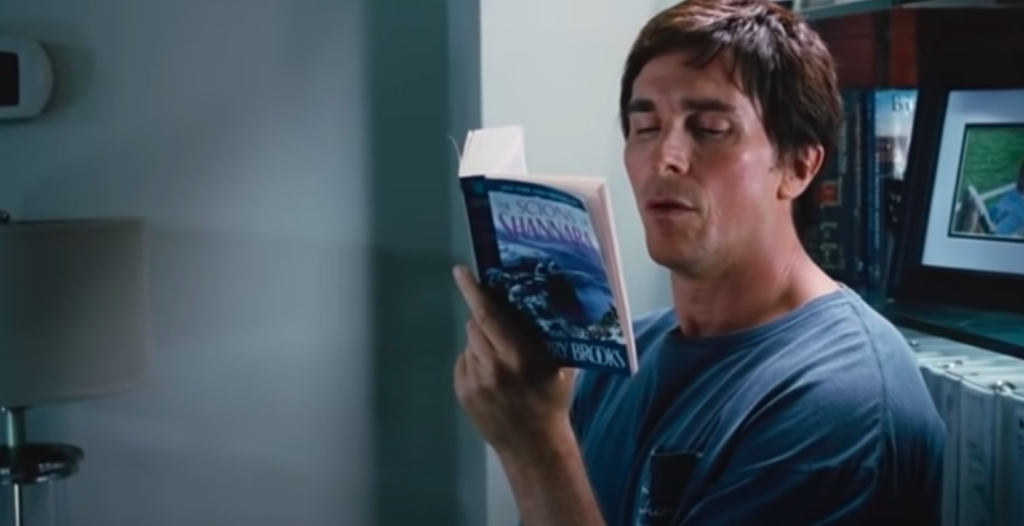

*Morpheus gets his name from the Greek god of dreams (there’s the method to the madness, all those Magnus Chase and Goddess Girls and Heroes In Training the kids read, that revolve around Greek and Roman mythology (and Rockstar can tell you the difference <cringe> hope of having any future grandchildren may now fall exclusively to our second born 😀 ) – so many things have their origin names in Greek/Roman mythology – drugs (morphine), spiders (arachnids), plants (Venus flytrap), shoes (Nikes), music (Calypso), several planets, etc etc) Btw – Scion Capital, the asset management firm “hobby” Michael Burry shorted the market through and made USD 725 mio from is named after his favourite Terry Brooks fiction, Scions of Shannara (#NerdsOfTheWorldRejoice!)

See, Burry’s original intended profession was Medical Doctor, until he was thrown out of an operating theatre for falling asleep on his feet while watching the attending surgeon operate, crashing into the patient’s oxygen tent thereby getting himself thrown out. (Oh, you thought you had a bad day at school?)

So anyway. Welcome to Wonderland…

I can create for you a 100% principal-protected investment product that potentially returns 5000% on your initial investment. You won’t even need to risk your initial principal investment, that’s 100% guaranteed by the bank. I’ll even let you pick the bank you want to invest with – whatever AAA rated ultra-snobby financial institution you read about in the FT.

What’s the catch?

How come you think there’s a catch? 😀 Here’s how I did it – First, I placed your initial capital in a Fixed Deposit (or bond, EMTN, MTN or ABCP issuance program… based on your preference re documentation). With the interest/ yield, I bought as many lottery tickets as I could.

The catch is of course your chances of actually getting that return on your investment – in this case it’s your chance of winning the lottery. (Replace lottery tix with various derivatives, the pricing of which are tied to the probability you will get that return).

A ship in the harbour is safe…. but that’s not what ships were built for.. Yet neither do ships go out to sea without checking the weather report. What makes it a…. “derivative investment” instead of a “voyeuristic trip to your friendly neighbourhood Mark 6 outlet” is the extent to which you try to improve your odds of payout by reading the research. You rely on research. And ratings agencies. W-aait..

Your initial return is 100% guaranteed. After all, they don’t call it AAA for nuffin’, Muffin. (And Brutus Is An Honourable Man 😀 )

So which is scarier, “junk” bonds, the super-duper risky stuff, or AAA mega-investment-grade?

Welcome to the world of what happens when Aileen has too much caffeine – because lemme tell you how AAA is the scariest thing onna planet.

(No, not even blaming the rating agencies much – as mentioned earlier, if you think in terms of derivatives, then by default by the time “everyone” collectively agrees something is a bargain (or conversely a terrible mistake), you are already too late to take real advantage of it (or hedge against the disaster – the pricing for hedging that “terrible mistake” is basically the actual cost of making that mistake today, present valued upfront)…

There is some value in this view – if you generally think in this way, you would not see value in what is attractive right now – you would perpetually see value in flaws and imperfections and would instead be looking for an ability to improve… The world has enough people who vie for the immediately attractive/ high achieving, they will already be very well taken care of…

(What’s an easy sports analogy – coach has two players, one whose skills have been honed and sharpened, another who has never been trained. If they’re producing close to the same results, which would you pick? I’d pick the slightly worse-performing, never been trained one – yup because with the right training think where the diamond in the rough could go. When you add a massive competitive push for results on a regular basis and with a rigid time frame however, no one has the time to polish a bloody…. rock that you also have to convince everyone else is actually a diamond :D)

A-nyway, lemme get back to my I Hate AAA Rant. So AAA is an Absolute Safest Investment. Many more AAA investors are pensioners or in some other way the Extremely Risk Averse than those who take on say, non-principal protected equity derivatives where you can potentially lose everything you put in. The majority of people who were told something was AAA would happily sink wayyy more cash in it than if they had been told something was incredibly risky.

Safe is worst than boring, it runs a much higher risk of being fraudulent. Know what I love about junk? No one pretends to be junk. In an email to investors, eccentric fund manager Dr Burry once described how his profile on Match.com had read, “I am a medical student with only one eye, an awkward social manner, and USD 145,000 in student loans”. His future wife wrote back, “You’re just what I’m looking for.” She meant Honest.

Fake AAA is the @sshole who makes you buy them flowers and put out because they think they so damned hot you be dying to be seen on their arm at prom tell your bosses how much of your investment portfolio has their name innit. Think Enron. Entitlement is lethal. (But adrenaline legal! )

Since risk and reward are correlated, you get very little reward for the (apparent) very little risk you are taking. If you create a structure with these things in the pot, you have very little yield to work with. It’s not even just about getting more return, there is no meat with which to buy real protection, which you are really going to need if you bought Junk in AAA Sheep’s Clothing. Nor can I buy very many lottery tickets at all buy any derivatives with a decent probability of payout for yield.

The risky are like salt. They make your entire dish tastier, more interesting. At the same time, everyone knows you are not meant to make your entire meal salt, and no one would expect you to. (Think: How much of our investment and spending is coloured by what others think.)

At the end of the day, whatever your market, whatever your recipe, whatever your favourite Nerf weapon, choice of location for a home, structured investment product, anything in life, you will find you cannot afford everything in the package. You want the heavy, battery powered Nerf gun? You will have to give up mobility and be a sitting duck in your Nerf Battles. But oh, let ’em come, you got the most rapid shooting thing in the bunch. You…. can’t stand sitting still and want action? Can’t carry a big, ungainly piece of equipment around, everyone else gonna see you from a mile away.

Sure you like some salt, sugar, curry, bananas, chocolate and the extra cheesy Doritos things. Now try putting everything in one dish 😀

We used to watch House Hunting reality tv programs – the biggest standout is never the structure of the building, not even that much whether it’s old or new (more because of the wiring and other stuff related to safety than the aesthetic – as I always tell HN, you want to look pretty? Sure! That is the easiest***, lowest hanging fruit. The inside however, that’s not so easy to hack..) Structure and decor you can tear down and rebuild easy, especially when you’re living relatively in the middle of nowhere). The thing no one can hack – is location.

AND the scariest bit is still yet to come…

So all that is AAA may not be gold. What happens if you then leverage – magnify – it. Which is how Dr Richard Thaler of behavioural economics and Selena Gomez come to illustrate how synthetic CDOs could inflate an initial USD 50mio mortgage bond product into potentially USD 1bio AND because of the “Dark Market” you never knew exactly how much that was, nor the conditions or documentations.

(Hot Hand Fallacy however can be qualified with muscle memory. I mean, if you’re talking sports analogy… Not such a fallacy because muscle memory is real, I mean…)

Now, what’s the other thing we have left to assumption? When you get a “guaranteed” product, you probably assumed that guarantee was solid. If AAA can fail however (Ok, stop screaming) – if AAA can fail, even after your hard-fought battle to make the right investment call, think – your counterpart may not be able to pay you your winnings.

Rabbithole. Iceberg.

This is why so many dealing room people, for all their logical…. math-ness, brashness, alpha-ness…. are superstitious. Religious. Almost 2 decades ago, in the dealing room in HSBC Singapore, I remember our then-head of the dealing room saying we had had a good year and – non-Christians please bear with him a moment while he leads the Christians in a prayer of thanksgiving.

You can financial-model til the cows come home, at some point you will realise the extent to which you are in control of nothing. (Go back and read the many ways in which one can blow holes in the way in which we assess market risk and ratings. Or anything, really.) They once said about the Titanic – unsinkable. Go back and see how they were raving in those days about that Marvel of New Technology (at the time) that was supposed to be Iceberg–proof. I remember hearing people quipping about “Iceberg Theory” – all these highly sensitive navigational instruments, just as the default probability calculators I was once sent to cut my teeth on pick up the tiniest of movements in risk – o.o5% increase in default risk, that kinda thing. But you hit a big enough Iceberg and it’s all going down anyway.

So you’ve seen the proverbial It’s-Cool-To-Sell-Scary-Mortgages, daredevil-jumping-between-tall-buildings videos. What happens next?

(Couldn’t find a shorter one – skip to minute 2.5 for the ending. The not boring, but horrifying numbers:

“For every 1% unemployment goes up, 40,000 people die…” Quora discussion here. Words are nothing without numbers. The reverse is also true. And at the end of it all, except for those two youths dancing around right after someone agrees to finally trade with them, even the few people who saw it coming and profitted immensely were not proud of it. No one was happy.

Epilogue:

There’s this scene in the movie where Brad Pitt helps the youths unwind their positions and take profit. He does so while on vacation, dumping some USD 200 mio in securities via wifi connection from a pub in Exmouth, Devon, “which smells like sheep.”

After that, The Powder Monkey pub where Pitt’s character Rickett (Ben Hockett in real life) offloaded the massive trade from 3,600 miles away liked to publicise how solid their wifi connection was 🙂

The difference between D’you Smell The Money Jared Vennett (Ryan Gosling) and the irresponsible, predatory mortgage brokers is rather like that of fictitious character Mike Wagner, COO and right hand to Bobby Axelrod, and the “sushi plebes” he yells at in the clip below (sorry bout the language – one thing they ALL have in common, the horrible language 😀 ), while dining with a Performance Coach (lika Psyche Evaluation Guy) he’s considering hiring to keep his traders in top form and mentally healthy.. (Axelrod is loosely based on real life hedge fund manager Steve Cohen – on a further aside, David Levien, one of the creators of the show, has estimated “at least 50” Wall Streeters have said a character in Billions is based on them):

(And then rather predictably “Wags” goes on a huge rant all the way down the sushi counter at the plebe “disrespecting” the sushi by among others speaking loudly on his cellphone 😀 well at least he remembered to lower back down his voice speaking to the chefs haha)

The HK protests have been worrying. I hope you and the kids are well and ok. Stay safe!

Yes we’re fine, thanks for asking, Elle. After the protests each time are also huge efforts to clean up after, scheduling around disruptions. Feel so sorry for Hong Kong and praying hard.

Hey, I wish there was a way to contact you personally since I understand that there are things that can’t be said on a public platform due to certain situations but I hope you and the kids are well. I miss the updates on them. Stay well.